Netflix has always been one of the most influential companies in the global entertainment industry, but in late 2025, the Netflix stock faced one of the sharpest declines in recent months. Investors who once saw Netflix as an unstoppable streaming giant are now questioning its valuation, the risks behind its ambitious expansion strategy, and the massive uncertainty surrounding its acquisition plans. Understanding why Netflix stock is down requires looking at market reactions, financial pressures, regulatory challenges, and long-term industry shifts. This comprehensive analysis breaks down every major element influencing the stock so investors can understand the real reasons behind the drop.

Netflix Stock Price Today and Why It’s Falling

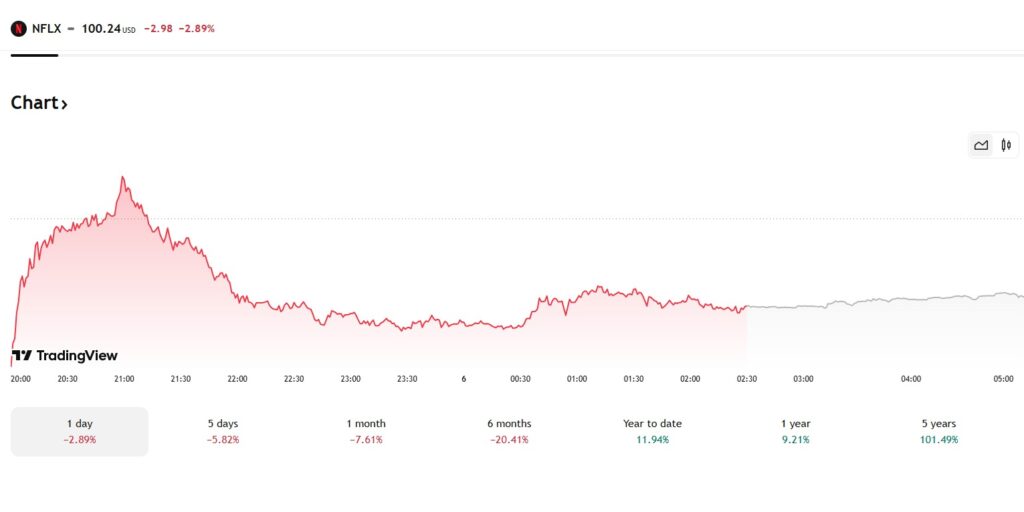

Graph Link: https://www.tradingview.com/symbols/NASDAQ-NFLX/

The recent decline in Netflix stock has been the result of a combination of financial concerns and regulatory anxieties. The stock recently traded near $103, marking one of its lowest levels in several months. A major reason behind this fall is the anticipation of a complex and heavily scrutinized acquisition involving Warner Bros. Discovery. Even though Netflix reported strong revenues of more than $11.5 billion in the last quarter, investors are worried about the sustainability of this growth as the company takes on one of the largest acquisition deals in media history. This uncertainty has created downward pressure, and analysts say the stock is highly sensitive due to its already elevated valuation.

Netflix Stock Price Table

| Metric | Value |

|---|---|

| Current Price | ~$103 |

| Previous Close | ~$103.96 |

| Q3 Revenue | ~$11.51 Billion |

| P/E Ratio | ~43.19 |

| 7-Month Low | Yes |

| Market Sentiment | Bearish / Cautious |

The table shows that even though revenue performance is stable, valuation and investor sentiment remain serious concerns. High-growth stocks like Netflix often fall sharply when any uncertainty appears, and that is exactly what is happening today.

Read More: Meta Platforms — Where Does the Stock Stand in Late 2025?

How the Warner Bros. Deal Pushed Netflix Stock Down

The biggest contributor to the decline in Netflix stock is the company’s decision to acquire Warner Bros. Discovery’s entertainment assets in a deal worth nearly $82.7 billion. This includes HBO, HBO Max, Warner Bros. film studios, and massive libraries of popular movies and series. While this move could reshape Netflix’s position in Hollywood, the market reaction has been negative.

A major source of fear is the unprecedented size of this acquisition. Investors worry that taking on such a huge deal will create a heavy debt load that may affect cash flow, profit margins, and Netflix’s ability to invest in new content. The deal also invites political and regulatory scrutiny since combining two of the world’s largest entertainment libraries may create what critics call a “media super-monopoly”.

Big Bet on Warner Bros. — Big Risk Too

On December 5, 2025 Netflix announced a landmark agreement to acquire Warner Bros. Discovery’s studio and streaming assets (including HBO/HBO Max, major film/TV libraries, and other premium content) in a deal valued at roughly US $82.7 billion (US$72 B equity + debt value). This acquisition, if completed, will give Netflix control over iconic franchises and content — a major expansion of its portfolio.

However, the deal has triggered a wave of concern from regulators, politicians, and industry groups, who warn it could create a media “super-monopolist.”

Also Read: Crypto Price Predictions 2025–2030: What Drives the Next Bull Run?

Regulatory Pressure and Antitrust Fears Hitting Netflix Stock

Regulatory agencies have already expressed concern about the size and impact of this deal. With Netflix already dominating global streaming, acquiring Warner Bros. raises questions about how much influence a single company should have over content production, distribution, and entertainment economics. Hollywood unions and industry groups openly oppose the merger. One union spokesperson even said, “This deal threatens the creative independence that Hollywood was built on.”

Such comments intensify skepticism around whether the merger will receive approval. Investors know that a blocked deal can destroy momentum, while an approved deal might create years of legal and financial complications. The result is heightened uncertainty and downward pressure on the Netflix stock price.

Financial Risk: High Valuation, High Debt, High Expectation

Another major reason Netflix stock is falling is financial overextension. Even before the Warner deal, Netflix had a high valuation and aggressive spending patterns. The company depends heavily on producing and acquiring content to keep subscribers engaged, which consumes cash at an enormous rate. Adding more than $80 billion of acquisition cost increases financial pressure dramatically. Investors understand that such deals affect credit ratings and cash flow cycles.

A case study worth noting involves Disney’s acquisition of Fox in 2019. While the deal helped Disney expand its content empire, it also strained its finances and affected earnings stability for several years. Analysts believe Netflix could face a similar situation, making the stock more volatile.

Why the Market Is Reacting So Strongly to Netflix Stock Movements

Netflix is more than a streaming service. It is a cultural force, a tech company, a content studio, and a global entertainment brand all at once. That means any major move the company makes affects the entire industry. When Netflix stock goes down, it signals broader concerns about the streaming market, subscriber fatigue, and the economics of producing massive amounts of premium content.

Market reactions also show that investors expect Netflix to demonstrate clear financial discipline. When the stock was rising earlier in the year, it benefited from confidence in its ad-supported plan, password-sharing crackdown, and cost-cutting efficiencies. Now that the focus has shifted toward expansion and debt, sentiment is shifting as well.

Chart Trends and Technical View: What the Graphs Show

Looking at the Netflix stock chart, we can see a clear downward trend. The stock has fallen below several key support zones, meaning traders expect further decline unless strong buying momentum appears. Technical indicators show weaker volume, suggesting that institutional investors are not aggressively buying the dip. The chart also reflects rising volatility, which often happens during mergers, large acquisitions, or regulatory investigations.

While charts cannot predict the future with absolute certainty, they reveal current market psychology. The repeated failure to break resistance levels points to sustained bearish sentiment.

The Future of Netflix Stock: Recovery or Continued Decline?

Netflix now stands at a major turning point. The outcome of the Warner Bros. acquisition will shape the company for many years. If regulators approve the deal and Netflix successfully integrates Warner’s assets into its ecosystem, the company could dominate global entertainment in a way no competitor can match. However, if the deal struggles or fails, Netflix could face years of lawsuits, financial strain, and industry backlash.

Quotes from analysts show divided opinions. One Wall Street analyst remarked, “Netflix is betting on size, scale, and storytelling. But the risks may outweigh the rewards in the short term.” Another analyst insisted, “This deal could give Netflix a decade-long competitive advantage if managed aggressively and intelligently.”

Whether Netflix stock rises or falls from here will depend on execution, regulatory outcomes, subscriber growth, and global market stability.

FAQ

1. Why is Netflix stock down today?

Netflix stock is down because investors are worried about the huge Warner Bros acquisition, rising debt, regulatory risks, and market uncertainty.

2. Did the Warner Bros deal cause the drop in Netflix stock price?

Yes. The $82.7 billion deal raised concerns about debt, antitrust issues, and whether Netflix can handle such a large integration.

3. Is Netflix facing antitrust or regulatory issues?

Yes. Regulators in multiple countries are reviewing the deal, and many believe it could create a media monopoly.

4. Will Netflix recover from the stock price drop?

Recovery depends on the deal’s approval, financial performance, subscriber growth, and how well Netflix manages new assets.

5. Is Netflix still financially strong despite the drop?

Yes, Netflix still earns strong revenue, but high valuation and new debt make investors cautious.

Conclusion:

The decline in Netflix stock is not due to a single factor. Instead, it is a blend of financial risk, regulatory uncertainty, investor anxiety, and high expectations placed on one of the most powerful companies in entertainment. The Warner Bros. acquisition could either turn Netflix into an unstoppable media empire or become one of the most challenging business decisions in the company’s history. As investors watch the situation unfold, Netflix’s ability to manage debt, grow revenue, and navigate global regulations will ultimately decide whether the stock rebounds or continues to slide.