-

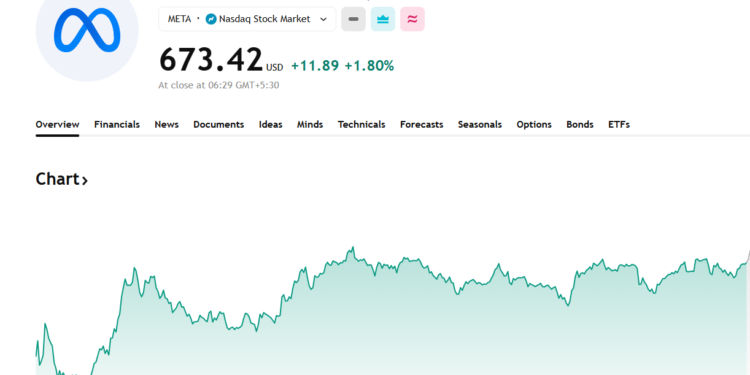

Meta’s share price recently closed around US $673–$674.

-

The 52-week range for META has been roughly US $479.80 (low) to ~US $796.25 (high) — which means the stock is currently well below its 52-week high.

-

Trailing metrics: P/E (TTM) around mid-20s to low-30s, and EPS (TTM) in the lower 20s (USD) range.

These numbers show that while META remains a heavyweight in market cap and valuation, it’s in a pullback phase relative to its recent peak — a context that makes its future trajectory especially interesting.

What’s Behind the Price Movement: Key Drivers & Company Strategy

Strong Core Business + Transition to AI

Meta hasn’t lost sight of what made it successful: its “Family of Apps” — platforms like Facebook, Instagram, WhatsApp, etc. — continue generating massive revenue.

At the same time, the company is accelerating its shift toward AI-driven services and monetization — particularly given growing investor enthusiasm for AI potential.

This dual focus — on stable ad-based revenue and potential AI-powered growth — is why many analysts still view META as having long-term upside.

Strategic Pivot: From Metaverse to AI & Cost Discipline

One of the biggest structural shifts for Meta in 2025 has been its decision to cut spending on its metaverse ambitions (the hardware/VR side, called “Reality Labs”) by as much as 30%, according to recent reports.

This is significant because Reality Labs had been a major cost sink, with cumulative losses since 2019 reportedly around $80 billion.

By reducing the burn there and redirecting resources toward AI — a business area with clearer monetization potential — Meta seems to be sharpening its financial discipline. For many investors, that’s a bullish signal.

Read More: Crypto Price Predictions 2025–2030: What Drives the Next Bull Run?

Recent Market Reaction & What Analysts Are Saying

-

Following the news of metaverse budget cuts + AI focus, the stock recently surged — adding tens of billions of dollars to Meta’s market cap.

-

Some analysts have raised their 12- to 18-month price targets to as high as US $800–$900 (or more), reflecting optimism about AI-driven growth and renewed investor confidence.

-

That said — as with any pivot — the path forward isn’t without risk. AI investments, shifting ad-market dynamics, and global macro uncertainty all play a role.

Chart Outlook — What to Watch

Based on the chart you referenced and recent technical notes:

-

META seems to have rebounded from a support zone (near lower end of its trading range), which may suggest a potential recovery or consolidation phase.

-

If momentum holds and AI-driven strategies start reflecting in actual performance, the stock could aim for previous resistance levels — possibly approaching or exceeding prior highs (depending on broader market conditions and company execution).

Explore Also: Beginner’s Guide to Crypto Price Predictions

Should Investors Care? (And Who It’s Good For)

Meta’s current state — with a mix of past success, future ambition, and structural reset — makes it appealing for different investor types:

-

Long-term investors who believe in the power of AI + social-media platforms: Meta’s discount from its 52-week high might represent a window to enter at a lower price before potential upside.

-

Value-oriented investors watching for signs of cost discipline and better returns after Reality Labs cuts.

-

Growth-seekers willing to accept volatility: If Meta succeeds in translating AI investments into revenue, the rewards could be substantial.

However — as with any big tech stock — there are inherent risks: regulatory scrutiny, competition in ad & AI space, and the ever-changing social media landscape.

Final Thoughts

Meta stands at a crossroads. On one hand, its foundational businesses remain solid and profitable. On the other, the company is undergoing a strategic transformation — moving away from speculative metaverse bets and doubling down on AI and monetization. For many investors, that makes this a potentially exciting moment: one where the company’s next decade could look very different.